Jessica I. Marschall, CPA, ISA AM

President: MAS LLC, Probity Appraisal Group, and The Green Mission Inc.

April 23rd, 2025

While the most straightforward path to wealth is through inheritance—particularly in the form of appreciating real estate or investment income—not everyone has the advantage of generational financial support. For those without a billionaire relative, or a mysterious great uncle who hands down millions in passive investment income, we have outlined several alternative strategies that may serve as a practical starting point.

At MAS LLC, we serve small businesses and their owners, and over the past twenty-five years we have closely observed the patterns that contribute to generational wealth-building. We have also seen the challenges that prevent others from achieving similar outcomes.

It is important to acknowledge that many factors influencing wealth accumulation are outside an individual’s control. Structural challenges such as wage stagnation, the outsourcing of domestic jobs, burdensome student debt, and rising living costs all present significant barriers. There is no singular path to financial security. However, we hope the insights provided here offer a meaningful foundation for those seeking to build long-term wealth.

From Earned to Passive Income: A Strategic Shift

One of the most powerful and often underutilized tools for wealth-building is the generation of passive income, especially through rental real estate. Earned income is typically taxed at ordinary income rates and is limited by the number of hours one can work. In contrast, passive income allows for financial growth with reduced active involvement and benefits from favorable tax treatment.

The Internal Revenue Service classifies rental real estate as a passive activity under Internal Revenue Code Section 469.[1] Generally, losses from passive activities may only be deducted against other passive income. An exception exists for those who actively participate in the rental activity and whose adjusted gross income is below certain thresholds. Taxpayers with an adjusted gross income of less than one hundred thousand dollars may deduct up to twenty-five thousand dollars in passive losses. This benefit phases out entirely at one hundred fifty thousand dollars of adjusted gross income.

Depreciation: A Hidden Tax Benefit

Depreciation enables real estate investors to deduct a portion of the property’s structural cost or “improvements” over time. Residential rental properties are depreciated over twenty-seven and a half years using the Modified Accelerated Cost Recovery System. This allows the taxpayer to claim an annual non-cash deduction while the property may still be appreciating in value. In plain terms, it is a paper loss that usually equates with sizable gains.

For example, if an investor acquires a property for three hundred thousand dollars and allocates two hundred forty thousand dollars to the structure or “improvements”, the annual depreciation deduction would be approximately $8,727. This deduction can create a paper loss, reducing the tax burden on rental income and possibly on other income if the taxpayer qualifies for the passive loss exception.

If passive losses exceed passive income, they are suspended and carried forward indefinitely. These suspended losses can be used in future years or fully released upon the sale of the property, subject to certain rules.

Watch for Passive Activity Losses[2], NIIT Tax from IRC Section 1411[3], and the dreaded Alternative Minimum Taxes when calculating gains on sales, as well as Depreciation Recapture under Section 1250.[4]

Appreciation: Investing in the Right Location

Although positive cash flow is important, long-term wealth is often built through appreciation. Property located in areas experiencing growth tends to increase in value over time, which can lead to significant gains at the time of sale or refinancing. Factors contributing to property appreciation include job growth, population increases, access to quality schools and transportation, and community investment in infrastructure.

Middle-class investors can enhance their wealth by focusing on acquiring properties in areas with consistent appreciation potential. Leveraging a fixed-rate mortgage in such markets ensures that debt remains stable while the value of the asset rises.

Leverage and Inflation: Friends to the Asset Owner

Real estate is one of the few asset classes where leverage often works in the investor’s favor. By securing long-term fixed debt, middle-class investors can use borrowed capital to grow their equity while inflation reduces the real value of that debt. Inflation typically drives up rents and property values, allowing for increasing returns while the loan amount remains unchanged.

This dynamic creates an environment where time and inflation act as wealth builders, particularly for those who hold appreciating, income-producing property.

Tax Planning for the Middle Class

Many middle-class taxpayers overlook valuable tax planning opportunities that can substantially reduce their overall tax liability. Effective strategies include maximizing contributions to retirement accounts such as traditional IRAs, Roth IRAs, or SEP IRAs; harvesting real estate losses through depreciation and deferring gains with a like-kind exchange under Section 1031; itemizing deductions where they exceed the standard deduction, particularly mortgage interest, charitable contributions, and state and local taxes; and claiming home office or vehicle deductions when actively managing rental properties.

Maintaining accurate records of capital improvements is also essential, as these increase the basis of the property and reduce future taxable gains. With diligent planning, the middle class can often lower their effective tax rate and keep more of what they earn and invest.

The Value of Intentional Financial Habits

Discipline is the foundation of wealth-building. Budgeting, saving consistently, tracking net worth, and resisting lifestyle inflation are essential practices. Windfalls should be directed toward investments or debt reduction rather than discretionary spending.

Financial success often comes from routine behaviors—automating savings, monitoring investment performance, and understanding where every dollar goes. The goal is to allocate capital toward assets that produce income or grow in value, not just to consume.

Investing in What You Understand

Warren Buffett has long advised investors to stay within their circle of competence. Middle-class investors are best served by putting their money into assets they can evaluate and manage. Real estate, index funds, dividend-producing stocks, and small businesses are all investments that can be understood and controlled.

Avoiding speculation and high-risk investments is particularly important for those building wealth from a modest base. It is better to earn a steady return on a familiar asset than to chase an uncertain profit in an unfamiliar market.[5]

Long-Term Thinking and Patience

Wealth is built over time. Compounding only works for those who stay invested and remain patient. Buffett’s fortune is a testament to decades of consistency and long-term thinking. Middle-class investors should adopt a similar mindset, trusting that their commitment to strategic ownership and sound planning will yield significant results.[6]

Choosing Safe Markets for Real Estate Investment

Middle-class investors should also be mindful of the real estate markets in which they choose to invest. Stable, appreciating markets with consistent demand provide the safest environments for long-term growth.

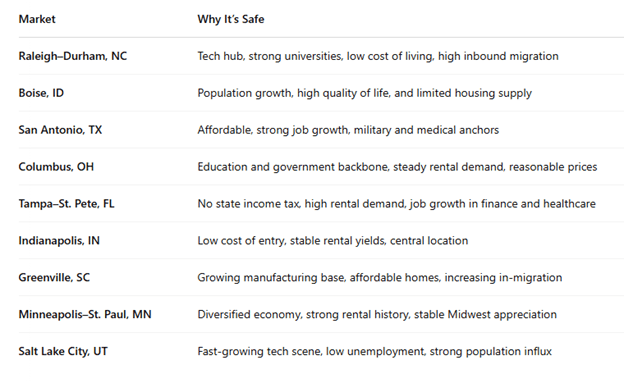

Ideal markets often include regions with job growth, population increases, diversified economies, and affordable housing relative to income. Examples of such markets in the current economic climate include Raleigh-Durham, North Carolina; Boise, Idaho; San Antonio, Texas; Columbus, Ohio; Tampa-St. Petersburg, Florida; Indianapolis, Indiana; Greenville, South Carolina; Minneapolis-St. Paul, Minnesota; and Salt Lake City, Utah.

These cities exhibit strong rental demand, economic stability, and long-term appreciation potential, making them well-suited for middle-class investors seeking to grow wealth gradually and securely.

Conclusion: Income is a Tool—Ownership is the Goal

Building wealth is not exclusive to the already wealthy. With strategic planning, middle-class individuals can convert earned income into appreciating assets and passive income streams. By focusing on tax efficiency, long-term ownership, and stable markets, individuals can take control of their financial future. Consistent effort, combined with patient investing and informed decision-making, creates the foundation for lasting wealth across generations.

[1] https://www.law.cornell.edu/uscode/text/26/469

[2] https://www.irs.gov/taxtopics/tc425

[3] https://www.law.cornell.edu/uscode/text/26/1411

[4] https://www.law.cornell.edu/uscode/text/26/1250

[5] https://finance.yahoo.com/news/warren-buffett-5-ways-build-110045620.html

[6] Ibid