May 8th, 2025

Jessica I. Marschall CPA

In recent years, our practice has seen a marked increase in clients either holding real estate for long-term investment or diving headfirst into the world of house flipping. This trend is fueled not only by rising home values, but also by the desire to create alternative income streams and build wealth through real assets.

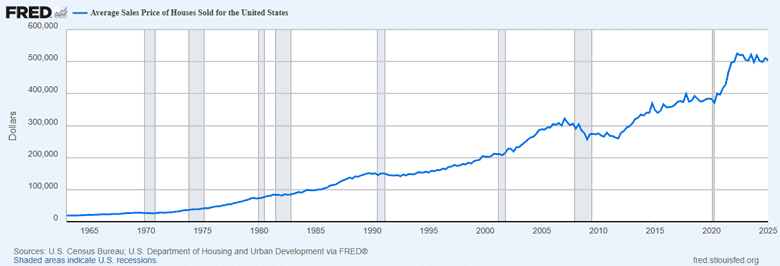

Housing prices have appreciated dramatically over the past several decades. According to the St. Louis Federal Reserve, average home prices have steadily risen significantly since the 1960s…2,400% to be exact. I experienced this firsthand—my husband and I purchased our first home in 1999: a four-bedroom, one-and-a-half-bath property in a charming, tree-lined neighborhood in Wauwatosa, Wisconsin, for approximately $170,000. Even with two professional incomes—mine as an accountant, his as an attorney—it was a financial stretch at the time. Today, Zillow estimates that same home is worth $723,100, representing a 325.29% increase in value.

For many of us fortunate enough to be Gen X-ers, homeownership came with sacrifice and discipline, but we were still able to purchase properties at a relatively accessible price point. As housing prices continue to climb, homeownership has become increasingly out of reach for many recent college graduates and young professionals, shifting demand toward the rental market.

Many of our clients are now investing in residential real estate—not just for the appreciation potential, but also to generate passive rental income. In doing so, they take advantage of Schedule E deductions, including depreciation. Of course, depreciation is a paper loss; as the above example illustrates, these homes are not deteriorating in economic value—they are appreciating significantly.

Meanwhile, another segment of our clients is pursuing the “fix-and-flip” strategy: purchasing distressed properties, making targeted renovations, and selling at a profit. Whether held for long-term rental or short-term resale, each approach carries vastly different tax implications.

The remainder of this article explores how the IRS distinguishes between real estate held for investment and property held by real estate dealers, the rules governing passive activity losses, and what happens at the time of sale—including depreciation recapture and the tax effects of converting property to personal use.

1. Real Estate Held for Investment vs. Dealer Property: Tax Classification and Consequences

The IRS distinguishes between real estate held for investment (IRC §1221 & §1231) and real estate held as inventory or for resale, often referred to as dealer property (IRC §1221(a)(1)). The classification significantly impacts the tax treatment of income, deductions, and gains.

A. Investment Property (Capital Asset or §1231 Asset)

- Held for long-term appreciation or rental income.

- Gains upon sale are generally taxed as long-term capital gains (currently max 20%, plus 3.8% Net Investment Income Tax if applicable).

- Losses may be deductible under §1231, subject to passive activity limitations (see below).

- Subject to §1250 depreciation recapture at a maximum of 25% on prior depreciation deductions.

- Income and losses flow through Schedule E (rental) or Form 4797 (sales of business/investment property).

B. Dealer Property (Flips or Inventory Property)

- Held with the intent to resell at a profit in the ordinary course of business.

- Gains are treated as ordinary income under IRC §1221(a)(1)—no capital gain treatment.

- Subject to self-employment tax if held by a sole proprietor or partnership.

- Cannot take depreciation deductions.

- Reported on Schedule C or through business entity filings as ordinary business income.

- Holding even one flip can lead the IRS to question the classification of other properties.

2. Passive Activity Loss Limitations: Non-Real Estate Professionals

Under IRC §469, passive activity losses (PALs) are generally not deductible against ordinary or portfolio income unless the taxpayer qualifies for a special exception.

A. Passive Loss Limits

- Individuals may deduct up to $25,000 of rental real estate losses against non-passive income if:

- They actively participate in the activity, and

- Their modified AGI is under $100,000. This deduction is phased out completely at $150,000.

B. Active Participation Defined

- A lower bar than material participation, active participation includes:

- Making management decisions (e.g., approving tenants or repairs),

- Having at least a 10% ownership interest.

- Passive losses beyond the threshold are carried forward and can only offset future passive income or be released upon a fully taxable disposition.

3. Real Estate Professional Status: Avoiding Passive Loss Limitations

To avoid IRC §469 passive loss limitations altogether, a taxpayer must qualify as a Real Estate Professional.

Requirements Under IRC §469(c)(7)

- More than 50% of the taxpayer’s total personal services during the year must be performed in real property trades or businesses (as defined in §469(c)(7)(C)).

- The taxpayer must perform more than 750 hours per year of services in those activities.

- Each rental activity is considered separate by default, unless the taxpayer elects to aggregate them by filing the Reg. §1.469-9(g) election with their tax return.

Audit Protection Tips

To substantiate Real Estate Professional status and avoid recharacterization under audit:

- Maintain contemporaneous time logs detailing daily tasks, hours, and property name.

- Avoid full-time W-2 employment in unrelated fields (this often triggers IRS scrutiny).

- Make the grouping election under Reg. §1.469-9(g) to consolidate properties.

- Show involvement in operational decisions: leasing, budgeting, managing contractors, etc.

4. Depreciation Recapture and Basis Adjustments at Sale

A. Investment Property Sales

- Upon sale, accumulated depreciation is recaptured under §1250 and taxed at a maximum rate of 25%.

- The remaining gain is taxed as either short- or long-term capital gain based on holding period.

B. Flipped Property Sales

- Since dealer property is not depreciated, no depreciation recapture applies.

- Entire gain is taxed as ordinary income, potentially at the taxpayer’s highest marginal rate (up to 37%).

5. Converting Investment Property to Personal Use (or Vice Versa)

When a rental property is converted to personal use (e.g., turned into a primary residence):

- Depreciation deductions must stop as of the conversion date.

- Upon sale, any depreciation previously claimed must be recaptured as unrecaptured §1250 gain.

- The basis remains reduced by depreciation taken, affecting overall gain calculation.

If the property later qualifies for IRC §121 primary residence exclusion:

- Up to $250,000 ($500,000 for MFJ) of gain may be excluded if owned and used as a primary residence for 2 of the past 5 years.

- However, prior depreciation is not excludable and will be taxed.

- Additionally, periods of non-qualified use (i.e., rental use after 2009) reduce the amount of gain eligible for exclusion under §121(b)(5).

Understanding the distinction between dealer property and investment real estate is critical for accurate tax reporting, maximizing deductions, and avoiding costly surprises during an audit. Whether a taxpayer is generating long-term rental income or flipping properties for short-term gain, the tax treatment under the Internal Revenue Code varies significantly—and so do the associated risks.

For those navigating rental real estate, the passive activity loss rules, real estate professional requirements, and depreciation recapture provisions must be clearly understood and properly documented. If a property is converted from rental to personal use (or vice versa), taxpayers must be aware that the IRS is attentive—particularly regarding unrecaptured §1250 gain and §121 exclusion limitations.

In a housing market where average home prices have increased by over 2,400 percent since the 1960s, many young adults find themselves priced out of homeownership and relying on the rental market—making investment real estate even more appealing for those who acquired property earlier.

Perhaps, after all the lectures, late-night support, and student loan co-signatures, the most meaningful gift a new college graduate could receive is not a briefcase or a coffee shop gift card—but a down payment.