The IRS (Internal Revenue Service) estimated tax underpayment penalty, also known as the underpayment penalty or the estimated tax penalty, is a penalty imposed on taxpayers who do not pay enough in estimated taxes throughout the year. Estimated taxes are payments made by individuals, self-employed individuals, and businesses to cover their tax liability when they do not have taxes withheld from their income through withholding from an employer or other means. This typically includes income from sources such as self-employment income, rental income, interest, dividends, and capital gains.

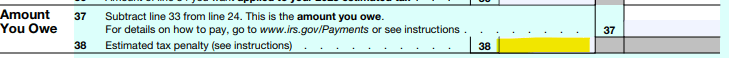

The penalty is assessed in the dreaded Box 38 on page 2 of the 1040:

The penalty is assessed when taxpayers underpay their estimated tax payments and don’t meet certain safe harbor provisions. To avoid this penalty, taxpayers generally need to pay at least:

- 90% of the current year’s tax liability: This means that if your estimated tax payments during the year add up to at least 90% of your total tax liability for the current year, you typically won’t incur a penalty.

- 100% of the prior year’s tax liability: If your adjusted gross income (AGI) is $150,000 or less ($75,000 or less if married filing separately), you can avoid the penalty by paying at least 100% of your prior year’s tax liability. If your AGI is more than $150,000 ($75,000 if married filing separately), you need to pay at least 110% of your prior year’s tax liability.

It’s important to note that these are general guidelines, and there are exceptions and special rules for certain taxpayers, such as farmers and fishermen.

The penalty itself is calculated based on the amount of underpayment and the applicable interest rate set by the IRS. The penalty is typically assessed when you file your annual tax return. The IRS Form 2210 is used to calculate and report the underpayment penalty.

Keep in mind that it’s essential to make accurate and timely estimated tax payments to avoid this penalty and to stay in compliance with IRS rules. If you believe you may be subject to this penalty, consider consulting a tax professional or using tax software to help you calculate and make appropriate estimated tax payments.

The IRS makes it quite easy to pay estimated taxes.

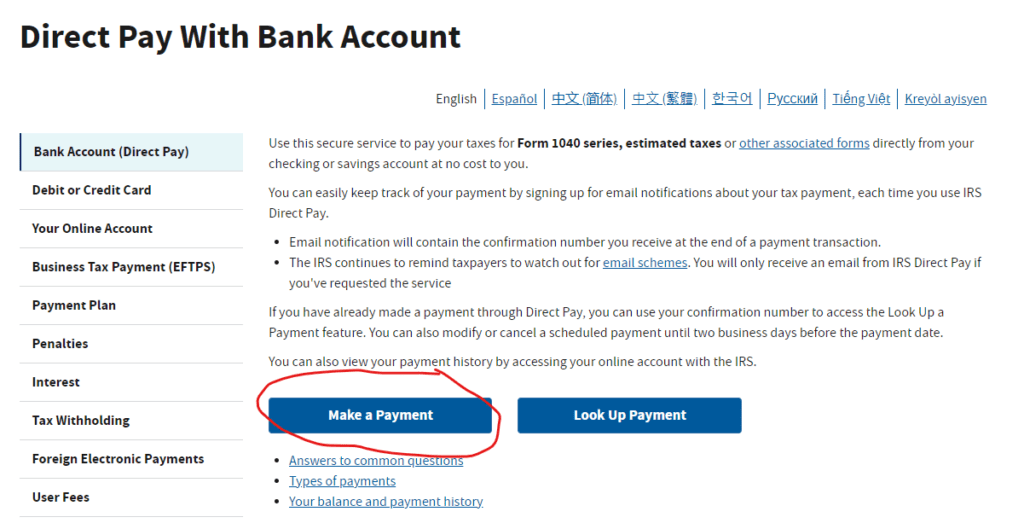

- Go to the Direct Pay website: https://www.irs.gov/payments/direct-pay

- Click on Make a Payment:

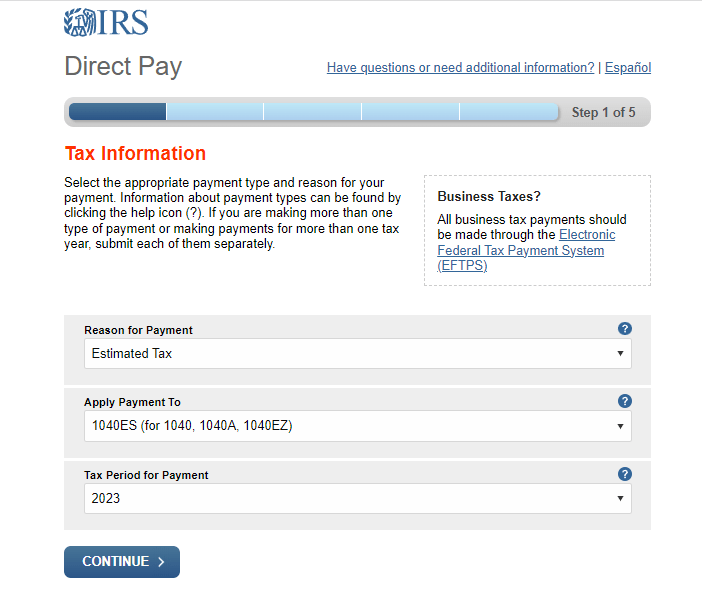

3. Make the following selections:

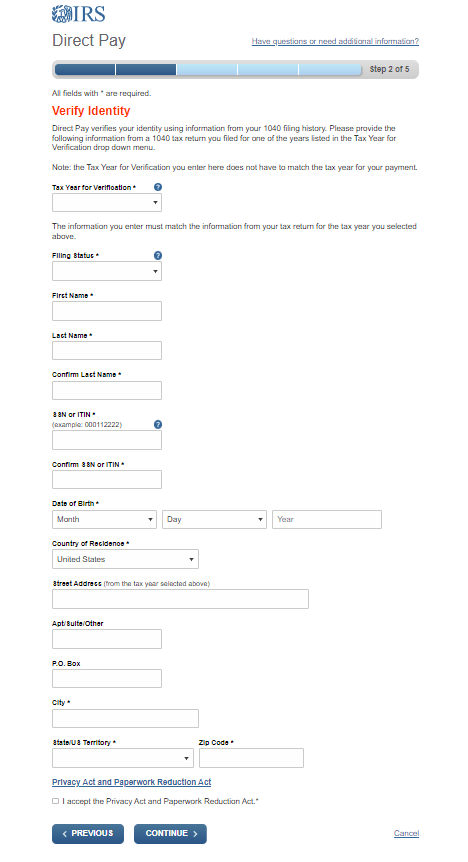

4. When verifying identity, make sure to use the first spouse listed on Form 1040. Clients have sometimes paid estimated taxes listing the second spouse first and it has not been properly applied to the tax account: