Article: Tax Season 2021 Recap-Relevant Tax Issues and How to (Hopefully)

Category: 1040 income tax, Charitable Donations, Itemized deductoins

Jessica I. Marschall, CPA, President Marschall Accounting Services LLC

August, 2022

One: What Went So Wrong with Federal Withholdings?

Were you in for a huge shock when you finished taxes and owed a huge debt to the IRS? Inexplicably, the IRS proactively adjusted W2 withholdings based upon the new W4 form released in 2020, which under-withheld taxes for about 95% of my clients. One client was single, had zero exemptions claimed on their W4 and had only 8% of taxes withheld on wages of around $300,000. Almost no one who makes $300k pays 8% in federal taxes!

Why would the IRS reduce withholdings given the lower tax revenue collections, and huge budget deficits? The federal government spent $4.57 Trillion in Covid-19 relief spending. The 2018 tax law change the Tax Cut and Jobs Act, is estimated to have added an additional $1-2 Trillion in additional deficit. Now would NOT be the time for the IRS to under-withhold from taxpayers W2s…but they did. The 2020 revised W4 did not map taxpayer data to produce accurate withholdings.

Couple this under-withholding with inflation, currently at 8.2%, and many taxpayers had no idea that they had a little extra money in each paycheck, as prices climbed.

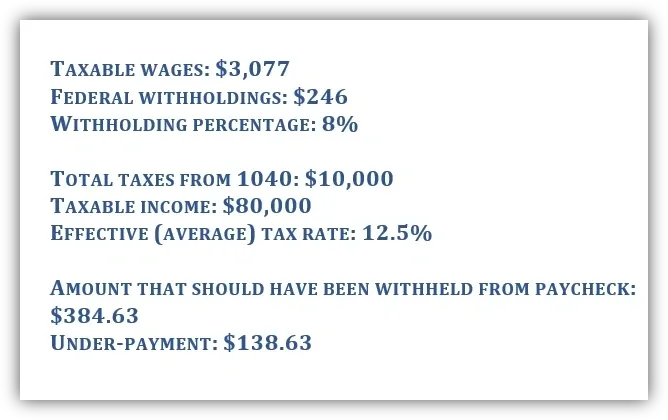

Check your paystub:

Divide federal withholdings by taxable income. Then, look at your 1040 and divide your total taxes (1040 line 24) by taxable income (1040 line 15) and compare these percentages. Keep in mind refundable credits on lines 27-31. If you are under-withholding by 4.5%, multiply your taxable income by the additional 4.5%. This is the amount you have under-withheld.

To fix this issue, you could revise your W4 to have an additional $138 withheld from each paycheck. However, if you are reading this in April 2022, you have already under-

withheld for 3.5 months. In that case, you can pay in through estimated taxes using the IRS online payment form: https://www.irs.gov/payments/direct-pay

Keep a screenshot of your receipt and the withdrawal from your bank statement. Numerous clients have had the IRS withdraw funds but not credit their tax account.

We are only six days out from 4/18 and I have had fifteen clients already receive collection notices from the IRS for underpayment of taxes. In some cases, the IRS did not recognize tax payments made despite pulling the funds from client’s accounts and sending confirmation of payments. In other cases, the IRS missed a client’s estimated payment—again, after withdrawing the funds and sending a payment confirmation. Finally, some clients had their EIP “stimulus” payment or Child Tax Credit recalculated. For two of my clients, the calculations were wrong and did not follow the IRS’ own formulas on tax forms.

Again, pay online and KEEP YOUR RECEIPT!

Two: How did the IRS Become this Non-functional?

The IRS had 23.5 million tax returns and pieces of mail from the 2020 tax year that were still unopened as of Tax Day. With ongoing budget cuts to the IRS as well as their pay level for staff CPAs and accountants being well beneath the average in the private market, it is a tough sell to procure an adequate volume of qualified employees.

The IRS has a dedicated IRS Pro Line, giving us a relatively quick way to resolve client issues. However, no one is there to answer even the Pro Line. I have precluded calling in for clients from my engagements. I had a client with an emergency, which required me to speak to a representative. I called in a total of 152 times and finally got a hold line and was disconnected. I called in an additional 43 times, received a 2 hour hold and then the resolution took 55 minutes. My day was shot. Meetings had to be cancelled as I needed to be available when or if the IRS answered. For me to offer IRS call-ins to clients, I would need to charge upwards of $1,000 per call.

For clients who cannot pay their entire tax bill by the due date, the IRS allows for payment plans to be created, some of which can be set up online. The IRS online payment plan requires clients to complete identity verification through their vendor ID.me. Once a client goes through the process of proving their identity, the website for making online payments is non-functional and gives an error message with a number and extension to call. Again, no one is there to pick up the phone and the message is, “Due to the unprecedented call volume your call cannot be answered, please try again.” Click.

Clients who cannot pay their taxes will now receive late payment charges because the IRS payment plan website is currently nonfunctional for most hours of the day.

We have the perfect storm of clients having huge and unexpected tax bills that cannot be paid on time, with no way to create a payment plan unless the hit-or-miss IRS payment plan site functions or if they can spend 2-3 days calling in and hoping to get a representative on the phone.

Concurrently, the IRS is sending aggressive collection notices to clients within days of tax filing, with notices full of miscalculations and mistakes, payments not recorded, letters dated later than today’s date, yet no one is there to answer the phone to assist clients to fix the IRS’ mistakes.

As CPAs, we have no solutions to offer clients except to draft response letters, which may or may not be opened by the due date given by the IRS to respond. Letters are sent by UPS or Fedex since we still cannot count on USPS to deliver, unless we send certified.

Here are a few articles with additional details on the state of the IRS in 2022:

1. ‘They went down hard’: IRS tax season woes rooted in pandemic, long funding slide: https://www.politico.com/news/2022/03/08/irs-2022-tax-filing-season-00014673

2. 7 Signs Tax Season is Shaping up to Be a Mess This Year: https://money.com/irs-tax-season-delays-customer-service/

3. Decades of Neglect Leave I.R.S. in Tax Season ‘Chaos’: https://www.nytimes.com/2022/03/04/us/politics/irs-chaos-tax-season-2022.html

4. The IRS faces backlogs from last year as a new tax filing season begins: https://www.npr.org/2022/01/24/1074793780/when-are-taxes-due-irs-phones-backlog

On to some other hot areas in the tax world…

Three: What to Know About Charitable Contributions

The provision allowing taxpayers who do not itemize to deduct up to $300 per taxpayer for cash charitable contributions ended in 2021. For 2022, if you did not itemize deductions, review your tax return and your Schedule A to see how close you came to itemizing. If you were within a few hundred dollars, consider keeping close track of cash and non-cash charitable contributions.

The net effect of donating $1 or $1 worth of non-cash donations is based upon your effective or average federal and state tax. Some states do not allow for charitable deductions on state tax returns. Assuming you live in Virginia, if your federal effective tax rate is 20% and your state tax rate is 5.5%, every dollar or dollars’ worth donated is a tax reduction of around $.25. If donating to Goodwill, snap a picture, keep a list of what was donated, and get a receipt.

Here is a link to states and their tax rate, and if charitable contributions are deductible from state tax returns:

Four: Advanced Child Tax Credit and EIP “Stimulus” Payments

The extension of the enhanced and prepaid Child Tax Credit was not renewed for 2022. It was housed within the Build Back Better bill, which was voted down in Congress. However, there appears to be bipartisan support for extending the enhanced credit and prepayment. Stay tuned.

In the meantime, the advanced payments created a nightmare at tax time. Clients needed to proactively report what they received based upon a letter from the IRS that arrived to taxpayers in a thin envelope. Again, USPS was used. Our mail can sometimes be found on the ground of our busy street, and we often have people from two zip codes over receiving our mail. The combination of the IRS and USPS has been catastrophic. Thankfully, the IRS site to retrieve the credit documentation did not crash and was accessible.

The same type of letter was sent for the EIP or third “stimulus” payment. With no further stimulus payments being extended, this will reduce one more complication from taxes in 2022 and help the IRS become more functional.

Five: Estimated Taxes and Box 38 Penalties

The IRS and state taxing agencies are a pay-as-you-go system. Estimated taxes are required if your pay-in is not 90% of where it should be. There is a penalty box on the 1040, page 2, line 38. Many clients populated the box this year due to under-withholdings and under-payment in estimated taxes. Year one? Ok. Year two? Watch out. The IRS can toss taxpayers into a mandatory withholding program for three years if they consistently underpay their taxes. I had a few clients receive correspondence that the IRS was proactively increasing their withholdings. By my calculations, they will be over-withholdings and receive a large refund at tax time. I have never successfully had a client removed from these mandatory withholding programs. Remember, refunds are not a good thing. You are lending money to the government without interest for up to sixteen months.

Ensure you pay into estimated taxes on the dates below:

April 15th

June 15th

September 15th

January 15th of the following year

Estimated online payments can be made on the IRS site here:

Most states also have online estimated tax payment options.

As stated above, keep a screenshot of the receipt as well as a copy of your bank statement where the amount is pulled. The IRS did not consistently apply these payments in 2021.

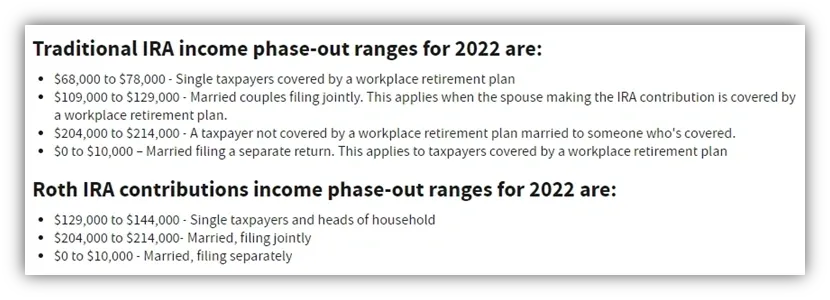

Six: Roth Conversions and Non-deductible or “Back-Door Roths”

There are two types of IRA investment accounts: Regular IRA or Roth IRA. The basics are:

Regular IRAs have pre-tax money going in. Money withdrawn at retirement will be taxed on the way out.

Roth IRAs have post-tax money going in. Money withdrawn at retirement will not be taxed.

Taxpayers can complete a Roth Conversion where traditional IRA funds are converted to Roth IRA funds.

If completed, the taxpayer pays taxes on the 1099-R distribution of funds at their current tax rate. If you convert, please ensure you calculate the taxes this will trigger. Also, ensure that your higher effective tax rate does not throw off ancillary tax issues stemming from the Adjusted Gross Income amount such as Child Tax Credit, Medical Expense Deductions, or that all-important FAFSA document for children going to college.

Additionally, there is currently a provision for a non-deductible IRA or “Back Door Roth.” Taxpayers who income too high for either an IRA or a Roth IRA, can contribute up to $6k each and instantly convert to a Roth IRA. Form 8606 is filed and the $6k is not taxable and is safely sitting in an account to grow and will not be taxed on the way out. Congress could easily close this loophole. It is a great option while it still exists.

Here are the income limits for IRA contributions in 2022:

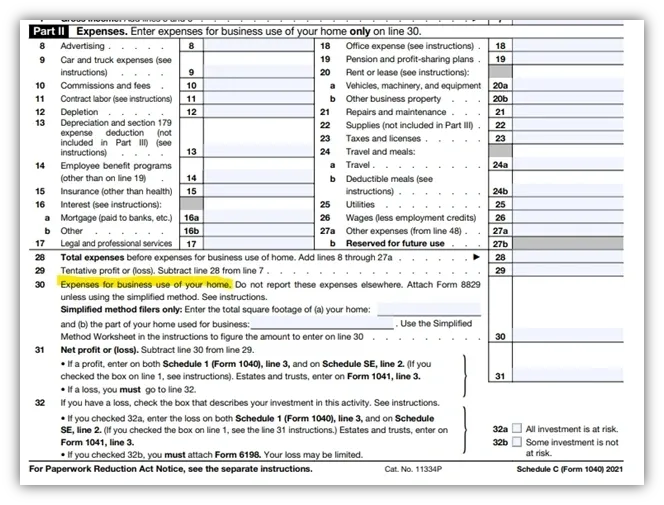

Seven: Self-employed, The Schedule C, and the S-Corp Election

Self-employed clients have multiple factors within their tax return not dealt with by wage earners.

Advantages include being able to deduct business expenses such as office supplies, dues and subscriptions, business property taxes, licenses, advertising and marketing expenses, automobile expenses, and the home office deduction.

A look at the Schedule C provides an idea of what can generally be deducted with the “Other” box including business-related expense not within the above-listed categories. However, ensure you carefully read the IRS publication on the Schedule C before trying to do your own taxes. Our firm has needed to contract with multiple clients who were audited due to using TurboTax for their small businesses. TurboTax will not tell you that expenses such as beauty expenses, business suits, and dry cleaning, to name a few, are NOT deductible. TurboTax will let you claim ANYTHING as a business expense. And do not get me started on TurboTax and the Schedule E where it will allow you to depreciate land. Hint: land is never depreciable.

The largest shock to Schedule C filers is when they see the following box for “Other Taxes” populated with a HUGE number on the 1040 page 2:

Self-employment taxes are 15.3% and include both the employer and employee portion of Medicare and Social Security taxes. Clients are typically irate when they see this tax calculation.

However, it should be remembered that W2 employees pay half of these taxes and mostly ignore them as they never see the money in their bank accounts to begin with—they are withdrawn with each payroll.

Additionally, there is the QBI deduction on page 1 of the 1040, allowing for a 20% deduction of net income from small business income. This deduction is extremely complicated for taxpayers exceeding an income threshold and those categorized for Specified Services Trade or Business (SSTB). This goes beyond the scope of this article but here is a great write-up on what this means.

Finally, there is a deduction of one-half of self-employment tax for Adjusted Gross Income, which results in another small amount of relief.

S Corp Taxation

Taxpayers can elect S-Corp taxation status by filing Form 2553 to the IRS by 3/15 for the year in which they wish to make the election. This moves the client to tax classification as an S-Corp, meaning they are a small corporation. The business still has pass-through income reported on the individual 1040. However, an additional tax return, the 1120S, must be filed by 3/15, which generates a K-1, that is reported on the 1040 Schedule E. S-Corp owners should be using accounting software such as QuickBooks and need to run payroll for themselves, as described next.

Once my clients reach net profitability of about $40-60k, we have the S-Corp talk. S-Corp owners or “shareholders” must put themselves on payroll with a reasonable wage. This wage is a qualitative valuation assessment. CPAs assist clients to ensure the shareholder is paying themselves a decent salary from the company. Using the range below, if a client is passing through $60k, then a $20k salary might be reasonable, $3k would not. The company and the employee both pay their half of self-employment taxes. Since the wage earner is also the business owner, they are paying both portions of the self-employment taxes, like a Schedule C filer. However, the additional business income, flows to the Schedule E without self-employment tax and only incurs federal and state income taxes. This can result in significant tax savings.

Finally, do not forget that the self-employed, either Schedule C or Schedule E filers, can invest in SEPor SIMPLE business investment accounts, much like mini-401k plans. Here are the details of the plans.

Eight: 529s

State run 529 plans are an excellent way to save funds for college while enjoying tax savings at the state income tax level. The investment plans are specific for each state and allow the taxpayer to reduce their state taxable income while investing for college and having the investments grow. Each parent can own an account for each child. In Virginia, a taxpayer can reduce taxable income up to $4,000 per account. As a mother of five children, with two in college and another starting in a year, college expenses are insane.

Here is a great article by Nerd Wallet, listing 529 plans by state:

Nine: 1099 vs W2

Many employers are hiring contractors rather than employees. This is especially true in the gig economy. Think Uber, Grubhub, Door Dash. Taxpayers receiving 1099s must remember that they are essentially reporting as a small business. They will pay additional self-employment taxes on the earnings, which can be a huge hit. Ensure a mileage log is kept for deducting the standard mileage rate (which is 58.5 cents per mile for 2022.) Also, consider paying in estimated taxes to ensure compliance and lessen the burden at tax time.

Employers and contractors must examine the relationship to ensure the contractor meets the criteria and is not a W2 employee in disguise. Employers pay fewer taxes and have much less liability with contractors. However, the IRS has tightened standards for the 1099 v. W2 classification.

Essentially, if the contractor works close to full time, the employer has full control over their work schedule, and the contractor uses the equipment owned by the employer, the contractor should be classified as a W2 employee. The IRS continues to crack down on these classifications. See this IRS publication for more information:

Finally, if you are an employer hiring a contractor, ensure you receive a legible and complete W9 before issuing a single payment. 1099s are due each year on January 31st. The late fees and penalties are substantial. The 1099 cannot be prepared without the contractor information from the W9. W2s are also due on this date.

Here is a link to the W9. If possible, have the contractor type in the information:

Ten: Paypal and Venmo 1099K: What They Mean

Clients have been extremely nervous about the 1099Ks received from Paypal and Venmo. The IRS is attempting to identify payments made to individuals, which should be captured as 1099 income and reported on income tax returns. If you are like me and swap Venmo amounts among friends when someone pays for dinner or go in on a gift together, those are not taxable transactions. However, if you are offering business consulting services and having someone pay you on one of these platforms that is taxable income.

Just keep it honest for your own conscience and also so you do not come under audit and lose many weeks of productivity during that time…not to mention your CPA bill.

Twelve: The TurboTax Trap

Our firm continues to gain clients needing services due to coming under an audit. Many of these are due to using self-preparation software, such as Tax Act, TurboTax, Taxslayer, etc. If clients come to our firm with a simple W2, I often tell them they do not need a CPA and would be wasting funds on our higher fees.

- However, if you have any of the following tax situations, you need a CPA:

- Small business income on Schedule C

- K-1 income as either a partnership and S-Corp and need to take additional deductions such as automobile expenses or Home Office Deductions.

- Rental income, especially when it comes to capitalizing assets and improvements and knowing what constitutes an expended repair or maintenance.

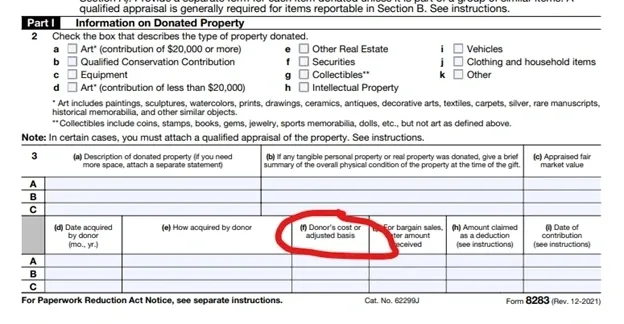

- A complicated Schedule A, including non-cash charitable contributions necessitating the filing of Form 8283 and possibly with inclusion of an IRS Qualified Appraisal.

- Foreign bank accounts, necessitating the filing of the FBAR form

- Sale of a personal residence—If you do this on self-preparation software ensure you accurately preclude the gain from the sale including the ownership qualification test and the $250/$500k limits. This is a huge audit area for taxpayers who self-prepare.

- Foreign tax credits beyond those reported on 1099-B or 1099-Div transactions.

- 1099-B transactions without original cost basis.

- RSUs, ESPPs with determination of potential AMT implications with RSUs

Concluding Thoughts

Good CPAs are quickly closing tax preparation arms of their practices due to the current state of the IRS. Tax consulting services are more lucrative and less of a headache. However, Marschall Accounting Services is committed to serving our individual and small business clients with tax preparation along with our consulting practice.

…and a plug to potential future CPAS: We need more CPAs! When considering career choices, majoring in accounting and passing the CPA exam opens many career opportunities. For those without the CPA credentials, good and reliable bookkeepers are in short supply and can have fulfilling and lucrative careers.

Finally, take a deep breath and hope for better days ahead for the IRS. In the meantime, I highly recommend the following movie, which I viewed this weekend:

Everything Everywhere All at Once

Featuring Jamie Lee Curtis as an IRS auditor, which will leave you in stitches. Not to mention, she details the perils of the Schedule C and when “Hobby Income” finds its way onto that Schedule. It definitely brought some levity as our firm continues to slog through the ongoing issues with the IRS. Sometimes humor is the only remedy!

Reach out for a free consultation for tax preparation, and accounting and tax consultation services.

Marschall Accounting Services

414-217-0147 ~ call or text