Article: Tax Court Disallows a Charitable Donation on a Technicality

Category: Charitable Donations

Jessica I. Marschall, CPA, ISA AM, AAA Associate Member

President & CEO Marschall Accounting Service, The Green Mission Inc., and Probity Appraisal Group

August 15th, 2022

The US Tax Court has delivered yet another loss of a non-cash charitable contribution, this time due to a technicality. In the latest case, Albrecht v. Commissioner, TC Memo 2022-53[1], a well-meaning donor lost the value of her entire charitable deduction for property donated to a museum due to a technicality in the written receipt provided by the museum.

Unlike earlier Tax Court cases disallowing non-cash contributions, this disallowance was due to a technicality within the Contemporaneous Written Acknowledgement, or receipt, provided by the nonprofit.

Some earlier Tax Court cases disallowed the charitable deduction due to deficiencies in the appraiser and appraisal as well as incomplete information on IRS Form 8283, the form that must accompany these donations.

Mann v. Commissioner, 2019 and lost appeal 2021, Loube v. Commissioner, 2020, and Chirelli v. Commissioner, 2021

We provide an overview of these cases and appraisal deficiencies in the article below:

The Contemporaneous Written Acknowledgement, or letter from the nonprofit substantiating the donation, must include the following information[2]:

Required for a donation of $250 or more and must include the following:

1. Name of the organization;

2. Amount of cash contribution;

3. Description (but not value) of non-cash contribution;

4. Statement that no goods or services were provided by the organization, if that is the case;

5. Description and good faith estimate of the value of goods or services, if any, that (an) organization provided in return for the contribution; and

6. Statement that goods or services, if any, that the organization provided in return for the contribution consisted entirely of intangible religious benefits, if that was the case.[3]

7. Inclusion of the nonprofits Employer Identification Number (EIN)

Additionally, the donor must retain records of the donation like a bank record or cancelled check or a written communication from the charity and include the date and amount of the contribution. If a non-cash donation is made exceeding $5,000 in value (or a group of similar items that has an aggregate value greater than $5k) the donor must procure an IRS Qualified Appraisal by an IRS Qualified Appraiser.

Both court cases Mann and Loube were based upon appraisals by the same appraiser and appraisal company. In Mann, the appraiser did not produce a qualified appraisal and in Loube, the appraiser forgot to sign the form and the client did not fill out Form 8283 in its entirety. (Please see the document at the end of the article for important information on completely and accurately filling out Form 8283.)

Is the Latest Tax Court Case Fair?

Many have bemoaned the latest Tax Court decision as unfair to the donor. This case certainly demonstrates a generous donor trying to support a museum with no fault of her own in making a proper donation to a qualified 501(c)(3). However, this is a stark reminder that the IRS is serious when it comes to substantiating non-cash donations.

As a CPA, we live and breathe technicalities and try to ensure every portion of a tax return is completed accurately with inclusion of corroborated and substantiated information. If reporting a stock sale with no original basis provided by the investment firm, we create a detailed attachment calculating the best estimate of original basis and submit it with the Schedule D. When capitalizing an improvement on a Rental Schedule E, we ensure our clients include receipts from contractors and vendors to retain in their permanent tax file to substantiate the improvement value.

What is Required for Non-Cash Charitable Donations?

When it comes to the deduction for non-cash contributions, the documentation standard is at the highest level across tax categories within the Internal Revenue Code. These donations have cost the IRS billions in lost revenue over the years and can be prone to abuse by donors, nonprofits, and appraisers. In the past year, our team has taken on an unprecedented amount of work for clients who have had their non-cash donations disallowed due to deficiencies in their original appraiser and appraisal.

These clients are typically audited 2-3 years in arrears and have lost their charitable contribution for the same handful of reasons. In some cases, the IRS is allowing them to procure an IRS Qualified “Retrospective” Appraisal from our firm. In these appraisals, we produce an accurate appraisal based upon a valuation date in the past that supersedes the appraisal obtained from their first appraiser.

The top reasons for these clients losing deductions, in order of frequency are as follows:

1. An unqualified appraiser. Some were found to have fabricated parts of their CV and/or are missing the requisite education and accreditation in a personal property appraisal organization.

2. An unqualified appraisal due to valuation methods. Some appraisers are using an erroneous interpretation of the Cost Approach to valuation such as the valuation method used in Mann v. US, rejected by the IRS and the same methodology used in Loube v. Commissioner. Not only is this inaccurate valuation methodology but it is quick and sloppy…it takes minutes compared to the weeks to prepare a correct appraisal using the market-based Sales Comparison Approach. Here is more information on the use of erroneous methods:

https://www.thegreenmissioninc.com/article/proper-deconstructed-material-valuation-in-a-qualified-appraisal Here is an article on correct valuation methodology: https://www.thegreenmissioninc.com/article/deconstruction-and-reuse-appraisal-standards

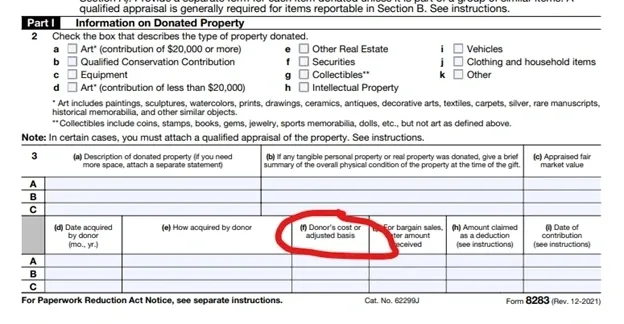

3. Missing information on Form 8283, specifically the box found below. Please see our document at end of the article for more information on the proper completion of Form 8283.

The Current Tax Environment

Our federal government is underwater financially. Covid spending cost upwards of $9 trillion dollars and the current tax law we are under, The Tax Cuts and Jobs Act (TCJA) of 2018, is estimated to have cost the US government around $3 trillion in revenue.

The IRS estimates that the top 1% of Americans evade the most taxes with an estimated $163 billion in uncollected taxes each year.[4]In fiscal year 2021, the IRS collected $92.6 billion in unpaid taxes and assessed $37.3 billion in civil penalties.[5]The IRS claims that $1 trillion in taxes goes uncollected every year.[6]The IRS is in no mood to show leniency to taxpayers claiming non-cash deductions unless they follow every letter of the law.

Higher taxes are coming, with the sunsetting of the TCJA in 2025, if not sooner. This translates into non-cash donations being worth more. If a person has a federal effective (average) rate of 25% and a state rate of 5% (and the state allows for charitable deductions) every dollar donated to charity results in $.30 in after-tax benefits. When tax rates increase, the value of the donation increases proportionally. Non-cash donations are one of the best tax planning tools we have to offer clients. Charities are helped by these donations, sustainability and environmental goals are met when people donate rather than trash property, and capital gains taxes are avoided when donating appreciated property.

We must ensure these donations are done following every rule set forth by the IRS.

To review, the most important considerations are:

1. Hire a qualified appraiser and use a reputable appraisal company.

a. Research the appraiser and company to ensure they were not involved in the Tax Court cases including as a DBA.

b. Ensure the appraiser has requisite college level education.

c. Ensure the appraiser has relevant experience.

d. Ensure the appraiser is an accredited member of one of the three personal property organizations sponsoring the Congressionally founded The Appraisal Foundation: American Society of Appraisers (ASA), Appraisers Association of America (AAA), or International Society of Appraisers (ISA)

2. Ensure the charity is willing to both provide a compliant Contemporaneous Written Acknowledgement andsign IRS Tax Form 8283. Many nonprofits refuse to do the latter.

3. Ensure IRS Form 8283 is completed accurately and in its entirety.

4. Our firm keeps records for all eternity…well beyond the requisite 5 years or 2 years post litigation, per the Uniform Standards of Professional Appraisal Practice (USPAP). Clients should do the same. The IRS typically audits going back three years, but they can go back as far as they like if they suspect fraud.

Please reach out to our companies for more information on non-cash charitable contributions and tax planning:

Marschall Accounting Services

(414) 217-0147

The Green Mission Inc

(540) 322-3884

Probity Appraisal Group

(540) 322-3884

IRS Tax Form 8283 Guidance

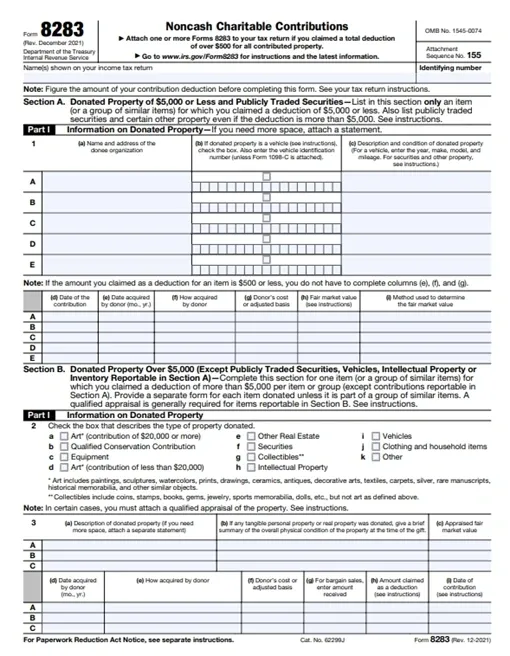

Please pay careful attention to the new IRS Form 8283. The taxpayer is entirely responsible for accurately filling out p. 1, Section B, Part I. We provide clients with help by checking the boxes on #2 and providing descriptions and input for 3 (a) (b) (c). Please ensure this section is filled out in its entirety and reviewed by your CPA.

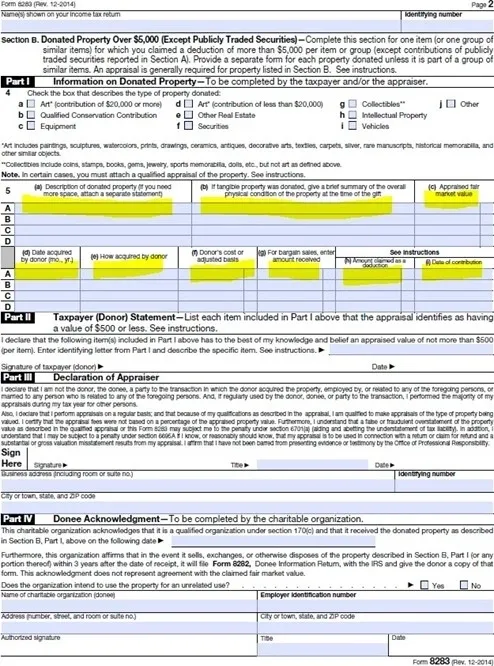

Non-monetary charitable deductions have come under increased scrutiny by the IRS. Loube v. Commissioner, January 2020 disallowed an entire charitable deduction because the appraiser did not properly fill out nor sign the

“Declaration of Appraiser”, the nonprofit did not fill out nor sign the “Donee Acknowledgement,” and, importantly,

the client did not fill out p. 2, Part 1, Boxes (a) (b) (c) (d) (e) (f) (g) (h) and (i).

As of December 2021, IRS Form 8283 has been updated. A major difference from pre-2020 forms is the movement of Section B to the first page. Here is the prior form 8283 page 2:

New 2021 Form 8283

The new Form 8283, like the 2020 version, includes an additional box “k” for Clothing and Household Items. Boxes (a) (b) (c) (d) (e) (f) (g) (h) and (i) remain and it is critical these are filled out completely and accurately by the taxpayer.

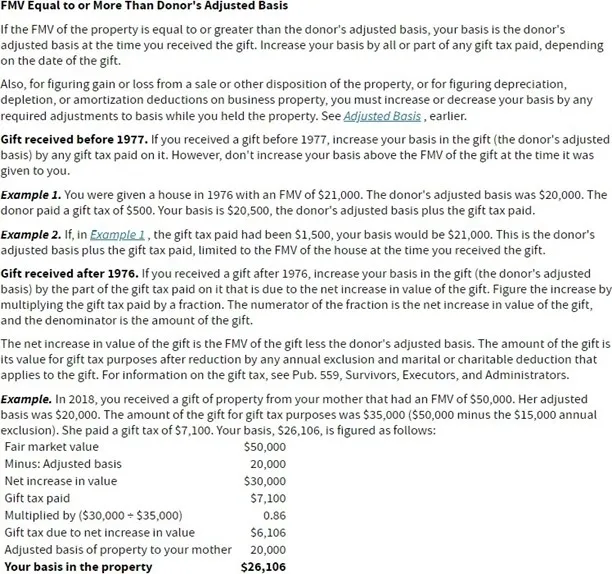

To assist our clients, we would like to provide IRS definitions of “Donor’s cost or adjusted basis” and provide a spreadsheet for the client and CPA to use. This spreadsheet will include the entire inventory of donated property, in line-item, and include a column for

the estimated acquisition date, how it was acquired (purchase, gift, inheritance, etc.) and the original cost or basis. We highly suggest you remit this detailed list with your appraisal when filing your tax return as either a pdf e-file attachment or have your CPA paper-file.

In most cases, the date acquired can be a ballpark figure just using the year. How the property was acquired is typically purchase but can also be gift or inheritance. The cost or basis will be what the client paid for the property or the basis from the gift or inheritance.

Example:

Property: 8-light French Chandelier How Acquired: Purchase

Original Cost Basis: $8,000

Calculating the basis for a gift or inheritance is more complex. IRS Publication 551 Basis of Assets includes the following language about the FMV equal to or more than the donor’s adjusted basis:

The basis for inherited property is calculated as follows:

Finally, the regulations for community property in the states where this is applicable is as follows:

Please find the entire publication at this link:

Please find the 2021 version of IRS Form 8283 here:

While we do not supply tax advice to clients, our CEO Jessica I. Marschall is also a practicing CPA and is happy to work with clients and CPAs to ensure sound understanding of Form 8283, “Noncash Charitable Contributions” to ensure it is filled out correctly along with the IRS Qualified Appraisal with the underlying opined valuation.

[2] IRC §170(f)(8)