Article:Tax Notes from 2022 Tax Season

Category: 1040 income tax, IRS, Small Business

Jessica I. Marschall, CPA April 21st, 2023

The bulk of tax season 2022 is over. As a group, CPAs are exhaling and questioning our career choices. As a group, we are fading fast. The AICPA estimates that 75% of CPAs will retire within the next 15 years.[1]Our practice witnessed an inflow of taxpayers seeking professional tax advice because their CPA was retiring or no longer accepting smaller clients or no longer preparing taxes.

We spotted several troubling trends among individual and small business taxpayers and hope our tax season lived experiences will help individual and small business taxpayers take actions to make future years predictable and easier.

Self-Preparation Tax Software

The number one issue among individual and small business taxpayers is the use of self-preparation tax software with a close second being working with a tax preparer who is not a CPA or does not have the experience necessary to know the Internal Revenue Code and apply it correctly.

Schedule C

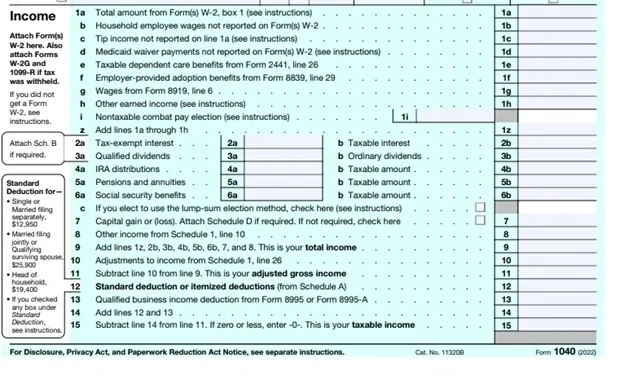

The Schedule C is where business income from Single-Member LLCs or Sole Proprietors is reported. The IRS refers to these entities as Disregarded Entities. Income passes through and aggregates with the other income comingled on page 1 of the individual tax return including wages, rental, retirement, capital and any other type of income. See below:

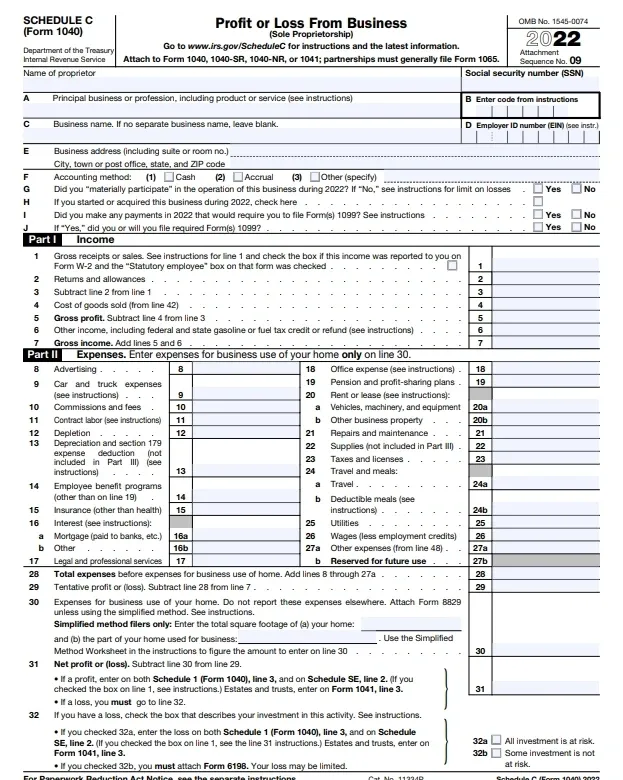

The Schedule C form looks innocuous enough, but the expense categories represent complex tax code. We often represent clients who have had their return come under review, or audited, because of this schedule.

Self-prepared tax software allows a taxpayer to enter ANYTHING on this schedule and does not issue a RED ALERT (!!!) if a taxpayer enters personal home mortgage interest as a full deduction on line 16a, counts all business and non-business mileage as deductible, deducts the value of drycleaning or professional suits (not deductible) nor will the software affirm that uniforms ARE deductible if required by the profession in the course of the business (think mechanics, painters, or electricians) of if they depreciate land over 5 years (land is NEVER depreciable).

To make matters worse, the IRS does not care if the preparer had good intentions or sought advice from a friend or relative or even an accountant. The onus rests with the taxpayer to report income in compliance with the IRC. Audits usually occur a year or two later and can cost a taxpayer thousands in recalculated taxes, underpayment penalties, interest, and other punitive fines along with attorney and CPA fees.

To make matters worse, the IRS does not care if the preparer had good intentions or sought advice from a friend or relative or even an accountant. The onus rests with the taxpayer to report income in compliance with the IRC. Audits usually occur a year or two later and can cost a taxpayer thousands in recalculated taxes, underpayment penalties, interest, and other punitive fines along with attorney and CPA fees.

What are Pass-Through Entities?

This leads to another common misconception among taxpayers and small business owners: how is business income taxed? Most of our small business owners report on Schedule C.

S-Corporations file a separate return, the 1120S, which is due one month before the 4/15 deadline on 3/15. If a taxpayer creates an LLC with more than one member, they defaultto partnership taxation and must file the 1065 by 3/15. When applying for the initial Employee Identification Number, please pay close attention to the number of members and the final determination of tax entity type.

Rental income and expenses are reported on the Schedule E and also “passes-through” to the 1040 with taxes at the individual level. The Schedule E is also where partnerships and S-Corps report their pass-through earnings.

Only Corporations filing the 1120 are considered separate entities. Corporation pay taxes as standalone entities and not at the individual 1040 level.

What this means is that the individual income tax rates apply to business income. If one taxpayer has five children and wages of around $60k they will have a much lower effective, or average, tax rate than a single taxpayer with the same $60k in income.

What is the Self-Employment Tax?

To add to the complexity, Schedule C filers trigger the dreaded Self-Employment taxes of 15.4% representing both the employer and employee portion of Medicare and Social Security taxes. Note that for 2023, the base for SSA taxes will be $160,200 and Medicare has no upper limit. These taxes populate as “Other Taxes” on page 2 of the 1040 line 23 followed through to Schedule 2 line 21. The taxes are substantial and are not eaten away with the above-listed “non-refundable credits”. Even with eight children and zero federal income taxes, income of $100,000 from a small business will still trigger the self-employment taxes. Only those credits on line 27-31 or “refundable” credits can eat away at this obligation. Please note that regular General Partnerships also trigger self-employment taxes.

The S-Corp is a great way to cut out a portion of the self-employment taxes. An overview can be found here:

Profit Motives

Another hot-button issue is that a small business must be able to demonstrate a profit motive and not just passive hobby income and expenses. Regulation Section 1.183-2(b) requires the following Nickerson factors, confirmed by US Tax Court, that must exist to prove profitable motive:

1. The manner in which the taxpayer carries on the activity;

2. The expertise of the taxpayer or their advisers;

3. The time and effort expended by the taxpayer in carrying on the activity;

4. The expectation that assets used in the activity may appreciate in value;

5. The success of the taxpayer in carrying on other similar or dissimilar activities;

6. The taxpayer’s history of income or losses with respect to the activity;

7. The amount of occasional profits, if any, that are earned;

8. The financial status of the taxpayer; and

9. Elements of personal pleasure or recreation.

Why is this important? Some clients have had prior Schedule C losses retroactively removed and reclassified as “Hobby” income. Most small businesses are in the red for the first year or two but must show that they are actively pursuing economic activity and income.

Why are Federal Tax Withholdings So Off?

Check W2 withholdings. Approximately 90%+ of our wage-earning clients had inadequate withholdings from their W2s despite making the correct status and exemption claims on their W4s. The W4 changed with the Tax Cuts and Jobs Act (TCJA) of 2018 when exemptions were removed, and the Standard Deduction was beefed up. The numbers do not cross over correctly.

We had single taxpayers making $120k in wage income with only 7% of federal withholdings. Again, the onus for accurate withholding lies with the taxpayer and they will be assessed the dreaded Box 38 Estimated Tax Penalty if withholdings are not accurate.

A quick fix could be as follows:

a. Wage income $100,000

b. Effective (average tax rate) calculated by dividing total taxes in box 24 of the 1040 divided by taxable income in box 15.

c. Let’s say that the average tax rate is 16%

d. Open a pay stub and divide federal withholdings by taxable wages. Let’s say that is 8%.

e. Over the course of the year, the taxpayer will be under-withheld 8% (16%-8%) or $8,000.

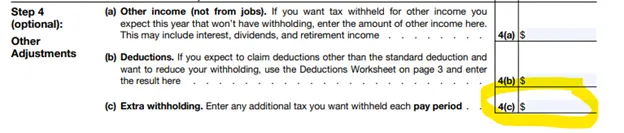

f. The taxpayer could add extra withholdings to their W4 in box 4(c) below:

This can be calculated by $8,000 divided by 26 pay periods or around $308 extra withholdings per pay period.

Please note that if a taxpayer is just reading this now, they are already under-withheld through April and need to calculate the catch-up payments to be made by January 1st, 2024.

g. The easier route is to make an estimated tax payment by the 4th quarter deadline of 1/15/24 through the IRS Direct Pay system:

Ensure the tax payment is mapped to the primary taxpayer’s name and Social Security Number (the first taxpayer listed on the return.)

Planning Tips for 2023

Our best advice for individuals and small business owners to better prepare for the season ahead:

1.Use accounting software ALWAYS for businesses. Simple accounting software like QuickBooks enables the taxpayer to aggregate revenue, expenses, assets, liabilities, and equity all in proper documented form, upload substantiating documentation, and calculate estimated tax payments.

2. Pay estimated taxes! These are not optional and are due at the federal level on 4/15, 6/15, 9/15, and 1/15 for Q1-Q4 for all Schedule C or other pass-through filers. Our federal and state income tax systems are pay-as-you-go and adherence to making quarterly payments is critical for compliance with the IRC.

3. Understand the financial statements. The Profit & Loss represents revenue in and expenses to apply against the revenue. The Balance Sheet is where assets (bank accounts, accounts receivable, vehicles, real estate) are listed and balance with liabilities and equity. Tangible assets and intangible assets must be depreciated or amortized, and the treatment and useful life is dictated by the IRC. For example, residential rental improvements must be depreciated over 27.5 years.

4. Plan for 2025: The current tax code enacted in 2018 is set to expire in 2025. This has many repercussions that we will cover as we approach the 2025 tax season. Before then Congress may make certain provisions permanent, and some will be a thing of the past. Some of the most important provisions for our individual and small business tax clients include:4. Plan for 2025: The current tax code enacted in 2018 is set to expire in 2025. This has many repercussions that we will cover as we approach the 2025 tax season. Before then Congress may make certain provisions permanent, and some will be a thing of the past. Some of the most important provisions for our individual and small business tax clients include:

a. Reinstating the limit on overall Itemized Deductions

b. Removing the $10,000 State and Local Tax Cap on the Schedule A

c. Removing the 100% AGI cash charitable donation limit

d. Moving the Standard Deduction back to lower levels, which translates into more taxpayers itemizing deductions (save those Goodwill receipts!)

e. Qualified Business Income deduction gone for good?

f. Special Depreciation Allowance—this is already down to 80% in 2023.

g. Exemptions will be back

h. Child Tax Credit limits will change

We look forward to working closely with our small business clients and charting a smooth and profitable path forward!