Article: S Corps-The Quick Facts

Category:1040 income tax, S Corps, Small Business

Jessica I. Marschall, CPA

January 7th, 2023

Businesses may choose S-Corp taxation on the date they start or may elect the tax treatment at a later date moving from a single member LLC or “Disregarded Entity”, or a partnership or multi-member LLC. An S-Corp is still a pass-through entity and income is reported on the 1040 Individual Income Tax Return.

Here are the basics:

Here are the basics:

One: Self-Employment Tax Savings

A top reason for conversion to S-Corp taxation is the savings on Self-Employment taxes. Single member LLCs report income on the 1040 Schedule C and partnerships and multi-member LLCs report income on the 1040 Schedule E. In most cases, these earnings are hit with an additional 15.3% federal taxes for Self-Employment taxes. This is the employer and employee portion of Medicare and Social Security. These are not offset by most credits and are usually a big surprise to new business owners on their 1040 below.

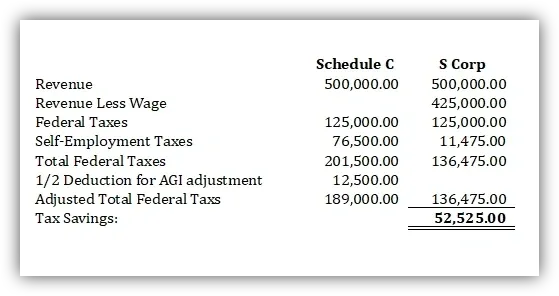

A picture containing table Description automatically generated.

S-Corps avoid a portion of the self-employment due to the wage component. S-Corp shareholders must be paid a reasonable salary based upon their CPA, industries, and the IRS’ best estimates. The rest of the income flows through as a distribution devoid of the additional 15.3% self-employment tax.

An example by the numbers, assuming a 20% effective or average tax rate and an S-Corp reasonable salary of $75,000. Revenue for the company is $500,000. The S-Corp pays the sole shareholder a salary of $75,000. The sole shareholder/employee must pay both portions of Self-Employment tax on the $75,000 since they are both the employer and employee. The net difference in total taxes is as follows. There is a ½ deduction for AGI for self-employment taxes, which tends to bring down the rate to about 11-12% based upon AGI, which is calculated within the table.

A taxpayer could save potentially $50k+ by electing S-Corp taxation.

Two: Making the Election

A taxpayer must file Form 2553 prior to 3/15 in the year in which they wish to make the election.

Three: Required Tax Return

The business must now file Form 1120S U.S. Income Tax Return for an S Corporation due 3/15 each year. This is a month earlier than the 1040 4/15 deadline. This is not a return to be completed on Turbo Tax or by a novice. Most accounting firms charge around $1,000 for these returns due to their complexity. The return then kicks out a K-1, which is reported on the Individual 1040 Schedule E, as S-Corp income.

Four: Payroll Requirement

An S-Corp must pay a salary to shareholders and use a payroll service or ensure quarterly payroll reports are filed. This is an additional added expense.

Five: Home Office Deduction

Form 8829 deduction for a Home Office is not available to an S-Corp. However, the shareholder can setup a reimbursement program.

Six: Earned Wage Income

Only the wage component is considered earned wage income for Social Security pay-in purposes. Whereas a Schedule C filer has paid in Social Security on the entire net income.

Seven: Record Keeping

A company converting to an S-Cor must employ careful accounting procedures. Meetings must be held documenting reasonable compensation and distributions. Accounting software is a must.

Eight: Shareholder Restrictions

An S-Corp must be a domestic corporation with only individuals and certain trusts and estates as shareholders, can have no more than 100 shareholders, have only one class of stock, and not be an ineligible corporation (certain financial institutions, insurance companies, and domestic international sales corporations).[1]

Key Take-Aways

Substantial tax savings can be achieved by electing S-Corp taxation status. However, be sure to understand all requirements and do not take shortcuts on any of the above-listed requirements. The IRS can easily revoke S-Corp taxation status if the above-listed protocols are not followed to the letter.