Article: The IRS Revises 1099(K) Guidelines

Category: 1040 Income Tax, 1099K

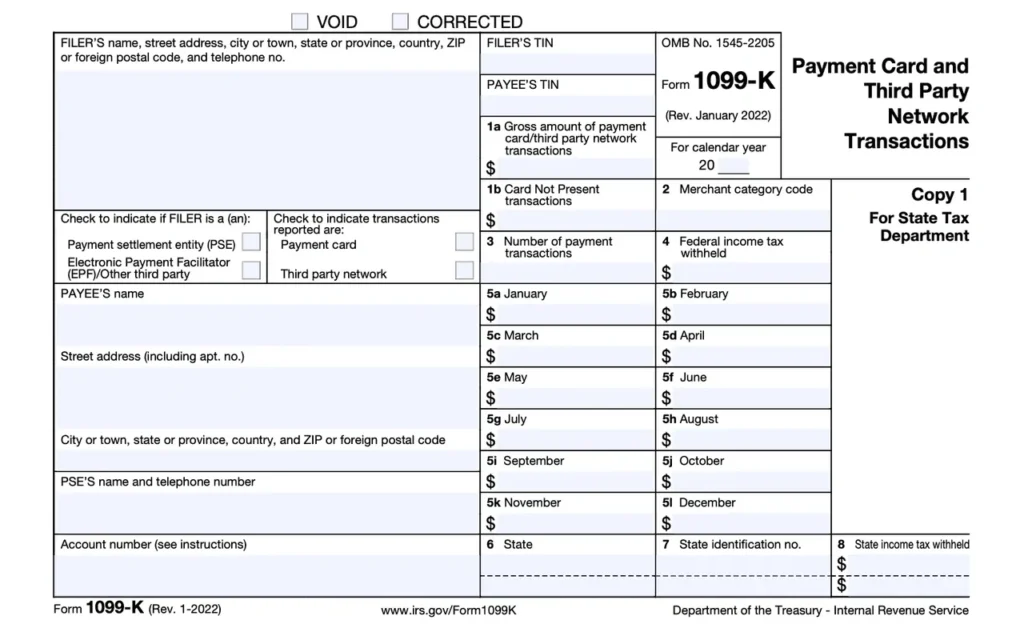

The IRS has lowered the threshold for 1099K Payment Card and Third-Party Network Transactions

These include Payment Settlement Entities like: Venmo, Paypal, CashApp, eBay, Etsy, Uber, Lyft, and Task Rabbit

What does this mean?

The threshold was lowered from $20,000 to $600 for reporting transactions.

The IRS is attempting to identify Independent Contractor income not claimed on individual’s tax returns. The Joint Committee on Taxation estimates that this could increase revenue by $1.08 BILLION in 2023 and $8.4 BILLION through 2031.This is a significant amount of revenue that is potentially evading taxation. Given the huge deficits we are in due to both the Tax Cut and Jobs Act and Covid Spending, it is understandable why the IRS is attempting to capture this income.

IMPORTANT: THIS DOES NOT APPLY TO TRANSFERS OF CASH FOR PERSONAL REASONS SUCH AS SPLITTING A RESTAURANT OR GIFT BILL!

Potential problems: The 1099K will be error riddled as personal spending will inevitably be intermingled with business income. If you receive an erroneous 1099K, you MUST contact the provider to request a revised form. When undertaking transactions on these platforms, they often ask what you are paying for. If you specify that a service or product is being purchased, this triggers reporting on the 1099K. Please use care in checking the correct box. You do not want a split family gift for Grandma classified as income.

The larger and most problematic issue is that the IRS has barely finished processing 2020 returns. No one answers our dedicated IRS Pro Line. We have no direct line to resolve tax issues. Tossing this major change onto the IRS will most likely result in additional insane tax season like Covid stimulus payments and Advanced Child Tax Credits. We can expect major delays in tax return processing with very few avenues of seeking resolution besides waiting…and waiting.

This article outlines the provisions and is a must-read for small business owners: