Article: SECURE Act 2.0 of 2022—What to Know

Category: 401K, Retirement

Jessica I. Marschall, CPA

May 17th, 2023

The SECURE Act 2.0 was signed into law by Congress December 2022 to enhance the SECURE Act of 2019, or the Setting Every Community Up for Retirement Enhancement. The new act includes 92 provisions to help taxpayers save for retirement more effectively.

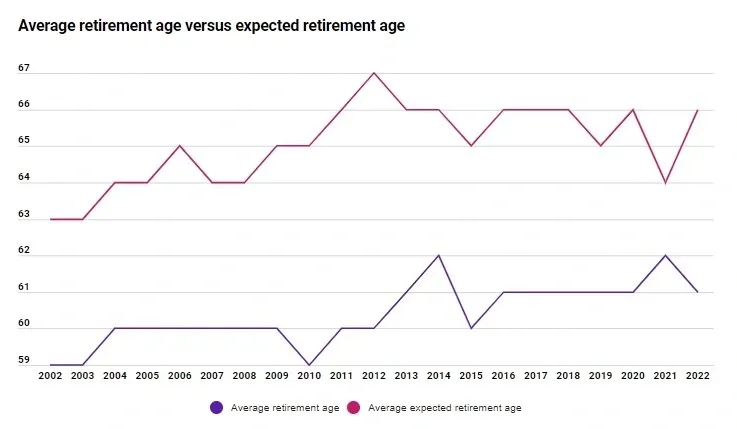

With hopes of making retirement contributions and distributions simpler and more beneficial to taxpayers, Congress enacted the provisions outlined below. The Act acknowledges the rise in the average retirement age rising from 59 to 62 since 2002.[1]

401(k) Contributions and Catch-up Contributions

The 2023 limit for 401(k) contributions for 2023 is $22,500. If over 50, taxpayers can contribute an additional $7,500 per year.

The Secure Act 2.0 adds an additional provision for taxpayers aged 60-63 allowing for a catch-up contribution of the greater of:

** $10,000, or

** 150% of the standard catch-up contribution ($7,500 * 150%=$11,250).

These contributions must be made to Roth accounts in 2024 and future years. These thresholds will adjust in future years for inflation.

Roth IRA vs. Traditional IRA

As a reminder, the difference between Roth and Traditional IRAs can be thought of as being taxed on the way in (Roth) versus being taxed on the way out (IRA). Choosing the right IRA requires the taxpayer to forecast whether their taxes will be higher now (the current year) or higher when the funds are withdrawn in future years.

Example: A married taxpayer currently has two dependents under 17 and an effective (average) tax rate of around 22% combined for federal and state. In 20 years, the taxpayer will no longer have the two $2,000 Child Tax Credits, the current tax law (TCJA) will expire meaning higher taxes and narrower brackets, and their future tax rates are estimated to be 30%. The taxpayer chooses to invest in a ROTH IRA. The investment is made with earnings that have already been taxed, allowing the funds to be withdrawn without taxes at retirement.

RMDS: Required Minimum Distributions

RMDs are dreaded by many retirees. These represent the amount that must be withdrawn from traditional IRA accounts each year. This ensures the IRS and state taxing authorities receive the taxes on these pre-tax retirement accounts.

The RMD age was 72 was phased into a higher age of 75 if you turn 74 after 2034.

From the IRS:

Beginning in 2023, the SECURE 2.0 Act raised the age that you must begin taking RMDs to age 73. If you reach age 72 in 2023, the required beginning date for your first RMD is April 1, 2025, for 2024. Notice 2023-23 permits financial institutions to notify IRA owners no later than April 28, 2023, that no RMD is required for 2023.

If you reach age 73 in 2023, you were 72 in 2022 and subject to the age 72 RMD rule in effect for 2022. If you reach age 72 in 2022,

** Your first RMD is due by April 1, 2023, based on your account balance on December 31, 2021, and

** Your second RMD is due by December 31, 2023, based on your account balance on December 31, 2022.[2]

The Act also removes the requirements for RMDs from Roth 401(k) contributions. Additionally, employers can now match employee 401(k) Roth contributions with either Roth or Traditional basis funds.

401(k) Changes

There is a 10% penalty for any distributions from a 401(k) that are not authorized under the plan due to the taxpayer’s age, date of account creation, and other provisions. The Act now allows for $1,000 to be withdrawn without penalty during one of three years, with the ability to repay the distribution.

The Act also automatically enrolls employees in a 401(k) plan if the employer has more than 10 employees starting in 2025.

The changes include the following provisions per section:

** Section 115 permits participants to access up to $1,000 (once a year) from retirement savings for emergency personal or family expenses without paying the 10% early withdrawal penalties (starting Jan. 1, 2024).

** Section 127 allows employees to set up a Roth emergency savings account with up to $2,500 per participant (starting Jan. 1, 2024).

** Section 314 permits survivors of domestic abuse to withdraw the lesser of $10,000 or 50% of their retirement account without penalty (starting Jan. 1, 2024).

** Section 331 allows victims of a natural disaster—a qualified, federally declared disaster—to withdraw up to $22,000 from their retirement account without penalty. The withdrawal is treated as gross income over three years without penalty (effective as of the passage of the bill).[3]

529 to Roth Transfer Rules

Taxpayers may set up 529 education saving accounts for their children, grandchildren, or other designated beneficiaries. The underlying assumption is that the beneficiary will attend college (or other educational training) and use all funds. However, a lucky break with a scholarship covering education costs could leave the beneficiary with unused funds.

The SECURE Act 2.0 Section 126 addresses this issue and allows excess 529 funds to be rolled into a Roth IRA under certain circumstances starting in 2024.

The rules for rollover are below:

** The lifetime maximum a 529 beneficiary can transfer under the rule is $35,000;

** The 529 account must have existed for at least 15 years;

** No contributions or earnings on contributions from the last five years can be transferred;

** The transfers are subject to annual Roth IRA contribution limits (but there is no upper income constraint).[4]

CPA and Financial Advisors

Taxpayers must conference with both their CPA and financial advisors to ensure the best retirement savings decisions are made. CPAs and financial advisors work in complementary roles and the best decisions are made when the team works in tandem to analyze future income streams, retirement funding, and tax planning.

https://www.fool.com/research/average-retirement-age/#:~:text=The%20average%20retirement%20age%20in%20the%20U.S.%20has%20held%20steady,ranged%20from%2059%20to%2062.

https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs#:~:text=Beginning%20in%202023%2C%20the%20SECURE,1%2C%202025%2C%20for%202024.

https://www.investopedia.com/secure-2-0-definition-5225115

https://www.journalofaccountancy.com/news/2023/mar/saving-college-new-529-to-roth-irs-transfer-rule.html